All you need to know about Stock Brokers in India

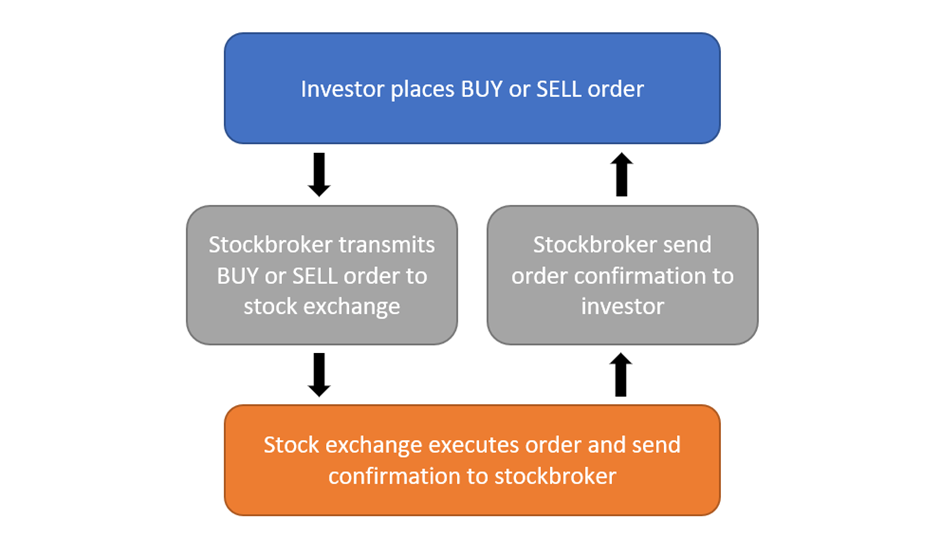

Stocks in the stock market are traded through stock exchanges. In India, there are two major stock exchanges- NSE and BSE. However, an investor cannot directly trade in stock exchanges. To buy or sell stocks through exchanges, an intermediary called a stock broker is required who helps facilitate the transactions.

A stock broker is a financial professional who has the authority to execute market orders i.e. buy or sell stocks and securities in a stock exchange on the investor’s behalf. Many market participants depend on stockbrokers’ knowledge and expertise regarding the dynamics of the market to invest in securities. A stockbroker can work either individually or with a brokerage firm. Sometimes, broker-dealers and brokerage firms are also called stock brokers. For providing this service, a stock broker charges a commission or a fee.

What are the different functions of a Stock Broker?

- Order Execution- Stock brokers buy and sell shares on behalf of their clients (individual as well as institutional investors) and handle the associated paperwork. For this, the brokers charge a commission. This may be either a flat fee per transaction or a percentage of the transaction value. They also act as a record keeper and keep records of all transactions, statements, and so on. Most of the bigger brokers provide trading apps and software for their clients to place their orders.

- Financial Advisory- Stock brokers give accurate advice on buying and selling stocks and other securities. Since they know the markets, they may advise a client on what stocks to buy and sell and when to buy or sell them. They thoroughly research securities before making such recommendations. Stockbroker also helps clients to make changes in investment strategies depending on the market conditions and let them know about any new investment opportunity in the stock market

- Margin Financing- In share trading, margin trading refers to the process where individual investors buy more stocks than they can afford. Top stock brokers also lend capital to traders who want to leverage their positions. This essentially means borrowing funds from the broker to take bigger positions in the market.

- Research and Educational Resources- A good stock broker always seeks to educate its clients on different aspects of investment and trading. Thus, stock brokers nowadays offer quality resources for the same. They share the findings of their in-house research team on a regular basis. If you are new to the stock markets, you may need detailed guides explaining market terminology as well as trading strategies. Ensure that the broker provides educational resources that cater to your investment level.

What are the different types of Stock Brokers?

Based on the types of services provided, there are two types of stock brokers- a full service stock broker and a discount stock broker.

Full-service stock brokers

Full-service stock brokers offer a full stack of services to their clients. These stock brokers provide research, trading, and advisory facilities with regard to stocks, commodities, currencies, mutual funds, and other asset classes. They also provide the facility to buy and sell stocks. Full-service brokerages are established players who have branches located all over the country. Clients can even visit these branches for service and advice.

Full-service brokers are the most customer-oriented. These brokers provide dedicated client relationship managers. They come with advice, customized support, portfolio management services, financial planning services, and services relating to wealth management. Full-service brokers also provide company reports and technical calls for investors and traders. Some of them offer banking and demat services as well.

For this reason, the fees charged by full-service stockbrokers are high, and the brokerage they charge is based on the total amount of trades that are executed by the client. The average commission charged by full-service brokers is 0.3% to 0.5% per trade. This is on the higher side. But the extra cost can be worthwhile given the wide range of services and products on offer.

Discount stock brokers

Advancements in technology have led to the rise of discount brokers who generally operate online. A discount stockbroker offers many products and services that are similar to a full-service stockbroker, but with smaller commissions. They offer cheap brokerage services for buying and selling stocks.

These brokers may not provide any additional services relating to market advice, financial planning, and tax planning. However, discount brokers are preferred by clients who cannot afford to spend large amounts on fees and commissions. Seasoned traders who like to take investment decisions on their own might choose this type of broker.

Hence, swing traders and day traders who are more active may find discount stockbrokers appealing. Moreover, the platforms serve active day traders and investors; hence, they provide more research tools and trading options than full-service platforms.

Today, India has a dematerialized stock market where trades are executed online. Stock brokers still carry out the same primary function—executing orders on their client’s behalf. But the venue has moved to digital channels. Whether it’s a full-fledged stockbroker or a discount broker, all are moving towards becoming an online stockbroker.

How are Stock Brokers regulated?

Stockbrokers are governed under the Securities and Exchange Board of India Act 1992, Securities Contract Regulations Act, 1956, and also the Securities and Exchange Board of India (Stockbrokers and sub-brokers Regulations), 1992. Stockbrokers are also regulated under other rules, regulations, and bylaws that SEBI may issue from time to time.

To perform stockbroking functions, every stockbroker must get the necessary licenses. For this purpose, they must register with SEBI and become a member of a stock exchange. Stockbrokers display their registration details on their websites and even on official documents. One can also visit the Sebi website and find details of registered stockbrokers.

Summing up

If you wish to invest and trade in the stock market, you will need to open demat and trading accounts. Whether you need a full-service broker or a discount broker will depend on your requirements, of course. If you understand how the markets work, you could save on costs by opting for a discount broker. On the other hand, say, you are a beginner in the stock market and need guidance at every step. Or, maybe, you lack the time or inclination to carry out market research and identify suitable trading opportunities. In both cases, a full-service broker that offers educational resources and in-depth research insights would be better suited to your needs.