Finfluencers dominating the social media platforms

More than half the world’s population is now on social media. The average time we spend scrolling comes in at nearly 2.5 hours per person per day. That being said, Social media content is no longer only about sharing pictures of a vacation, being entertained by the musings of kittens, or watching a tutorial on how to bake chocolate chip cookies. For many, social media has become an indispensable source of information on all aspects of life, including news, information, and advertising.

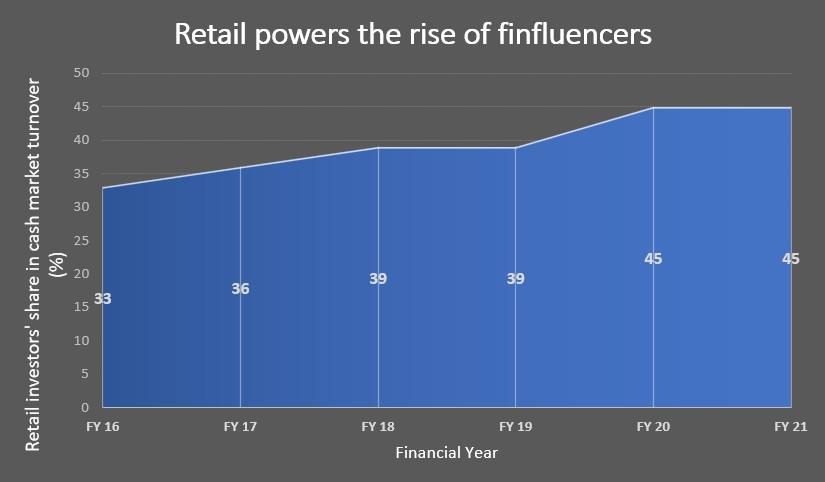

And, for a growing number of people, it’s now the go-to place for tips and hints on what to do with their money. Audiences are looking for the briefest nuggets of information, provided to them by ‘finfluencers’ (financial influencers). Telling them how to save their money – and how to invest it.

Shaping the future of investing with finance-related content

According to recent research from Emplifi, a U.S.-based customer experience platform provider, finance influencers published more than five times as many videos on YouTube as other types of influencers did from January to August of the previous year. Finance influencers on Instagram were similarly more active, publishing more than twice the number of posts other influencer types did over the same period. The research also found that finance influencers on YouTube gained nearly double the number of subscribers that other types of influencers did for the previous year up to August. Instagram finfluencers gained more followers than all other influencers.

In the last couple of years, there has also been a rapid growth in people subscribing to platforms such as TikTok, Twitter, and Spotify, as modern savers look beyond more traditional sources such as the business pages of newspapers. The hashtag #FinTok now has more than 2.2 billion views, with short videos of less than a minute giving tips on everything from car insurance hacks to guidance on how to invest.

Decoding the growing popularity of finfluencers in India

A simple reason why financial influencers are gaining a substantial audience might have to do with the very nature of the videos and the content they put out. These influencers are churning out content on finance, a complex and often boring topic, and breaking it down for consumption into a format where it is enjoyable and can be comprehended by those who aren’t well-versed with the financial jargon but are willing to learn to manage their personal wealth.

Another reason behind their gaining popularity is India’s low financial literacy rate. According to the National Centre for Financial Education’s 2019 survey, only 27% of Indian adults meet the minimum level of financial literacy as defined by the Reserve Bank of India. This is a sector where the gap between the knowledge and information available to the public and the experienced practitioners is very vast. And to cover up this gap, people often turn to widely available informative sources on the internet. The finfluencers give advice openly on social media platforms on an array of financial topics ranging from stock market trading, and personal finance, to mutual funds.

In India, some of the popular finfluencers are Pranjal Kamra, Ankur Warikoo, Sharan Hegde, Rachana Ranade, and Akshat Shrivastava.

Finfluencers under SEBI’s lens

This community of finfluencers has caught SEBI’s eye and the institution is putting down rules to govern this growing base. The sharp rise in the number of unregistered investment advisors giving out non-credible financial tips on various social media platforms has made the market regulator, SEBI worried.

It is yet to be seen what the new guidelines would comprise. The 2013 SEBI regulations for RIAs were introduced to regulate the offline mediums via which financial advice was shared. Following the current trend, online channels must be regulated as well, or else the 2013 RIA regulations will hold meaningless.

Setting up regulations for influencers is going to be a little tricky. There is no mechanism to know who is consuming their content and if the regulation is too strict, their content may be flagged for violating freedom of speech. Stricter entry barriers in terms of minimum education qualification and networking requirements will lead people to find other ways to dole out bits of advice. Also, the regulatory body should specify what constitutes financial advice and financial education. If a finance teacher who is teaching macroeconomics is regulated under these proposed guidelines, it won’t be fair to those seeking true financial education.

From a consumer protection perspective, financial regulators in the Asia Pacific (AP) region have taken digital tools and platforms into account in regulations and guidelines. In order to mitigate potential risks, financial regulators have also been educating the general public to avoid scams by issuing warnings on suspicious activities. Some regulators in the AP region have also provided guidance on how finfluencers can avoid misleading consumers. They have also taken initiative to develop and implement regulations targeting the online promotion of financial products. The promotion of complex financial products or high-risk products through online distribution and advertising channels is more closely scrutinized by regulators given the potential for the large financial loss they may cause to the investors.

Way ahead with regulations

The only way proper scrutinizing can be achieved is by creating a self-regulatory digital system that promotes transparency. The goal should rather be to single out good finfluencers based on credibility and expertise. This will also ensure there is better content created under peer pressure. Also, a standard operating procedure (SOP) needs to be followed on what needs to be disclosed while creating financial content.

SEBI (Securities and Exchange Board of India) is also planning to create a Data Lake Project to increase its surveillance of social media to track and prevent fraud. It is also looking at closer coordination with the banking and telecom sectors to get the call records and financial statements of the companies or individuals under scrutiny. It has created an online complaint cell called ‘SEBI Complaints Redress System (SCORES)’ where you can complain about fraud or suspicious activities via social media along with any other complaints you have.

The upcoming guidelines and SEBI's current efforts will help ensure transparency and accuracy in conversations. The government recognizes the importance of content creators and is working towards making these influencers a trustworthy source of information. However, it will be interesting to see what these guidelines are, after which we will have more clarity on how it works. Until then, try Covesto for full transparency in finfluencers' portfolios.