Women and Stock Investing in 2023

Women are venturing into spaces that men have long dominated. However, Finance remains a male-dominated profession, especially at the top. With more new opportunities in finance for women, thanks in large part to women who have been pioneers in the field, women are increasingly becoming financially independent and are playing an important role in the process of making financial decisions. 67% of women are now investing outside of retirement, compared to 44% in 2018, according to Fidelity’s 2021 Women and Investing Study. Women also consistently post better investment returns than men, both as individual and institutional investors.

That’s great to hear, but lower wages and lack of confidence hurt women’s ability to succeed as investors. On a global average, women earn 23% less than men for the same work. It can be easily said that gender pay gap challenges continue to prevail, and until men and women each parity, it is important for women to take on the mantle of investing their hard-earned money smartly.

As per a survey conducted by an Indian financial firm, DSP Winvestor Pulse, in 2019, only one-third of women take investment decisions by themselves. This speaks volumes about how little women are exposed to the world of investing. Surprisingly, even as many women are becoming financially independent, the decisions of investing in stocks, bonds, or even real estate are still often linked to the men of the family. The concept of aggressive investing continues to be absent in the lives of many working women. Suffice it to say, stock market trading remains a far-fetched idea. They still prefer saving for their future in bank accounts or investing in jewelry like gold.

The benefits of investing for women are plenty. And, the right time to invest money is at the earliest possible opportunity. Hence, investing should be a part of women’s financial plans from the early years of their careers. There is nothing to worry or feel underconfident about because if you are new to investing, you are not alone. The number of female investors is surging. A 2022 global survey from social trading and investing company eToro found that of the 9,500 female investors surveyed, 48 percent of them were new to the market over the past two years.

Understanding How Women Invest

It will be a great help for new beginners in understanding how women invest and why they excel because it is observed that women investors consistently outperform their male counterparts.

Risk Aversion and Self-Control Attitude

Studies show that women spend more time researching their investment choices. And while they do take on less risk than men when it comes to investing, that doesn’t mean they’re risk averse. Rather, they’re simply more likely to take on appropriate levels of risk with their investments than men. Both of these findings make for better investing outcomes. And because women are more likely to have good age-based asset allocations, they achieve proper diversification to help protect their money, regardless of market condition, according to Fidelity research.

Less Impulsive Investors than Men

The stock market tends to be volatile, and that can drive investors to act impulsively and lose money in the process. But data shows that women don't tend to react to market fluctuations the same way men do.

Wells Fargo reports that single women trade 27% less frequently than single men. Robo-advisor Betterment has found that women change their asset allocation 20% less frequently than men in their portfolios. Furthermore, men log into their investment portfolios almost five times a week on average, whereas women average fewer than three logins per week. It is said that by trading more often, and without enough research, men reduce their net returns. These lower net returns aren’t just from poorer investment performance, though. Trading may result in extra commissions and higher taxes on their investments. The higher trading costs might not be an issue if you managed to consistently buy outperforming assets, but the average investor is unlikely to pick winners most of the time. That is why the social trading platform Covesto cumulates the best trading opportunities by top traders and makes them available to the masses.

More Disciplined Savers and Investors

Despite grappling with substantially lower paychecks on average, women tend to have higher savings rates than men. In a 2017 Fidelity survey, women saved an average of 9% of their annual paychecks, compared to an average of 8.6% saved by men. And Vanguard reports that women at all income levels have higher retirement plan participation rates than men.

More savings are directly related to more capital to invest. In a 2021 investor survey, Wells Fargo found that women tended to have a more disciplined approach to investing that may have helped them achieve better risk-adjusted returns.

How Women Can Become More Successful Investors

It's clear that when it comes to investing, women are doing a lot of things right. They're saving a respectable portion of their income, trading at a reasonable frequency, and choosing investments that let them outperform men.

But women still have work to do, and 41% regret not investing more of their money, report by Merrill Lynch and Age Wave. As such, women should pledge to take a more proactive role in securing their futures.

Tips for women before investing

In these times of sky-rocketing inflation and unexpected economic downturns, the need for a well-planned and calculated investment strategy is crucial for everyone. Consider the following steps to create a successful investment plan:

- Evaluate your financial goal: Make sure to define your goals so you can pick appropriate investment options suitable for each specific goal.

- Consider the tenure of your investment: If you are looking for immediate returns, you should choose a short-term instrument. However, if your goal is not an immediate one, you should invest in a long-term instrument.

- Analyze the risk involved in the investment: Each investment tool carries a certain level of risk, which may affect the returns that you will receive at the end of the tenure of the investment. Ensure that the risk involved is aligned with your risk appetite.

- Don't wait for the right time to invest: The only right time to invest is right now. The sooner you start, the higher can be the sum accumulated.

- Learn more about investing: Talking with an investment professional or a financial planner can help you understand the basics of investing — things like setting aside enough cash for an emergency, defining your time horizon and risk tolerance, and developing an appropriate asset allocation. You can also learn about investing by joining social trading communities like Covesto and interacting with top traders across the world.

Author’s Personal Note

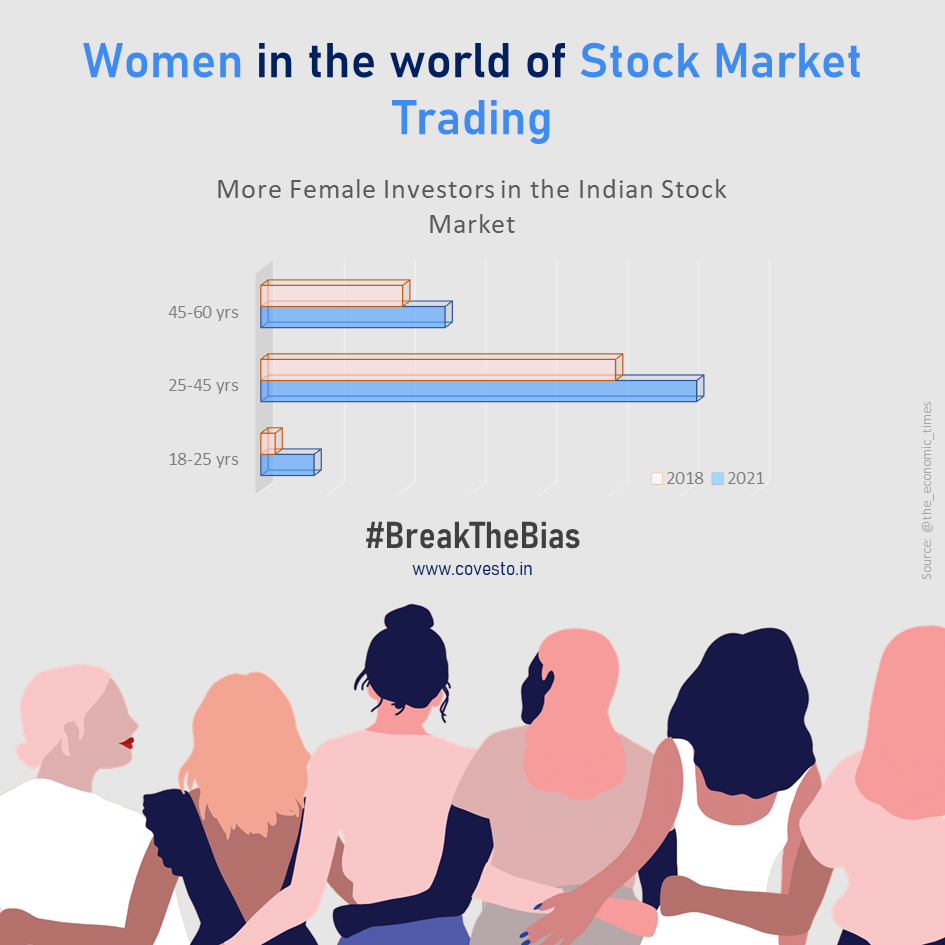

As a woman founder of a fintech start-up in the Indian stock market, I believe women have come an incredibly long way, but still have a long way to go. The share of female investors and female business owners has surged over the past few years, and the pandemic was an impetus for many women to start their own businesses or invest for the first time.

I have seen my mother change her opinions regarding investing and trading in the last few years. I am extremely delighted that I was able to influence her to break her shell and try new investment instruments. I hope to bring many others on board on this investing journey. Whenever faced with questions regarding how to invest, please remember that one of the best things you can do is ask for help. There are no stupid questions, and the doubts you have today were once, in all probability, the same as others had when they were first starting out. What matters is starting. Start investing with Covesto.