Comparison of Top Stock Brokers in India

Demat or dematerialized account is one of the main requirements for buying and selling shares in the equity markets. These accounts are maintained by depository organizations like NSDL and CDSL in India. Just like a bank account holds your money, a Demat account holds your shares or securities. It is needed only when you want to trade or hold shares on a delivery basis. If you want to trade in the future and options (F&O) only, then there is no requirement for the Demat account. A trading account is enough for dealing in the F&O segment as they are settled in cash. With the rising potential of the Indian capital markets, many people are interested in opening Demat and trading accounts.

Where to start the Broker Selection process?

A stockbroker (a Depository Participant) is needed for opening a Demat account. There are dozens of stockbrokers out there, that offer hundreds of features. Each broker has its own pros and cons. And, every investor has his own needs. Choosing a stockbroker isn't too different from picking a stock. It starts with knowing your investing style —and of course, determining some investment goals (beyond making money, of course).

New investors look for brokerage platforms that are easy to navigate and have strong educational tools and resources to help guide their investing journey. Seasoned investors are more into trading and look for brokers that offer better trading tools and lower intraday charges. Investors with lower capital want low minimum balance requirements. Now, which one would be the best for you? To answer that, you'll need to ask yourself below mentioned questions before selecting an online broker to use.

- Am I a beginner? If so, you'll want to find a broker with solid education resources and ideally a paper trading account to practice in. You'll also want calculators and analysis tools to help you plan, invest, and manage your portfolio. The quality of tools and resources can vary widely by a broker, but generally, the larger brokers have a much wider selection.

- How much can I afford to invest right now? Some brokers require a larger initial investment to open an account and access the trading platform. If you have a small amount of money, you'll want a broker with a low to no account minimum.

- Am I a trader or an investor? While investors can usually get away with a web platform or app, the complex needs of traders generally require a customizable desktop platform with all the bells and whistles.

- What kind of assets would I like to invest in? While most brokers offer the basics of stocks and ETFs, you may find other seemingly standard offerings like bonds and options are far from universal. If you are interested in trading forex, futures, cryptocurrency, and so on, you will be looking to larger brokers with asset offerings far beyond the basics.

It can be a hassle to change your broker once you have actively started investing. So, it's important to take the right start with the right broker. We’ll explore the best brokers out there so you can better understand the strengths of each platform. First, let’s look at the parameters for comparison that are essential while choosing a broker. Then, compare India's most trusted brokers side-by-side, and choose the one that best matches your needs.

Parameters used for Stock Broker Comparison

It is crucial to select the right stockbroker. If you’re currently wondering how to choose a stockbroker in India, here are some parameters that you could consider.

Ease of Opening an Account

This is one of the most important parameters to consider while choosing a broker. The process of opening an account should be simple, hassle-free, and quick. The broker should offer online account opening options and the process should be completed within a few days.

SEBI mandates a complete process for service providers to follow when creating a Demat account. However, they can simplify some aspects of the steps to open a Demat account. For example, a physical account opening takes approximately five days, whereas e-KYC takes less than two days.

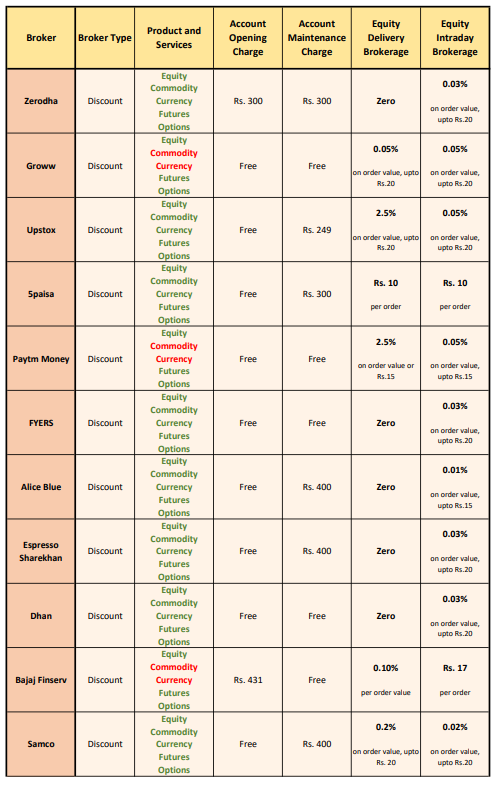

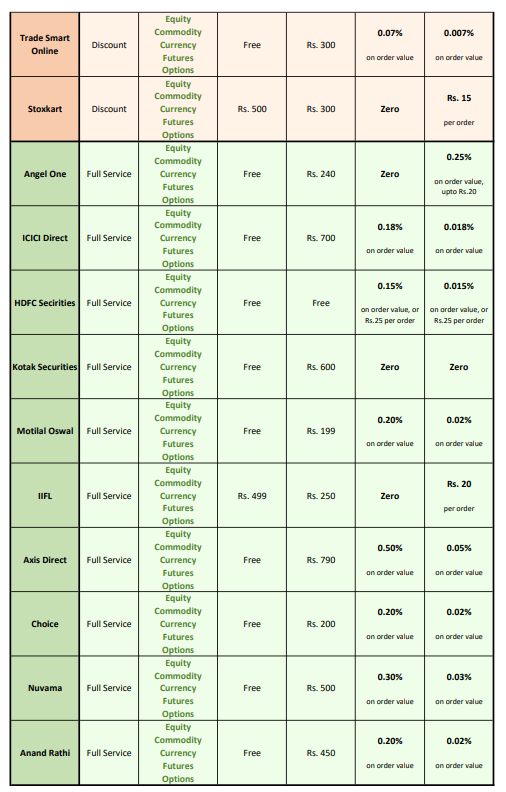

Account Opening Charges

Some brokers charge account opening charges, while others do not. It is important to compare the account opening charges of different brokers before making a decision.

Brokerage Charges

Brokerage charges are the fees that a stockbroker charges for executing trades on your behalf. These charges vary from broker to broker and it is an important parameter to consider as it can have a big impact on your overall returns. Lower brokerage charges mean more savings for the investor.

It is important to compare the brokerage charges of different brokers before making a decision. Some brokers offer flat-rate charges, while others charge based on a percentage of the transaction value. Additionally, some brokers may offer discounts for high-volume traders.

Annual Maintenance Charges (AMC)

Some brokers charge annual maintenance charges, while others do not. It is important to compare the annual maintenance charges of different brokers before making a decision.

Leverage/ Margin

Leverage or margin is the amount of money that a broker is willing to lend to an investor to trade securities. Higher leverage means more money to invest, but also more risk as you are borrowing money to trade and can lose more than your initial investment. It's important to compare the leverage or margin offered by different brokers and choose one that aligns with your investment goals and risk tolerance.

Trading Platform

The trading platform is the software that you will use to execute trades and manage your portfolio. A good trading platform that is easy to use has all the features you need, and is reliable is essential for effective trading. It should be user-friendly, easy to navigate, and should offer advanced features like real-time market data, charting tools, and technical indicators.

Most brokers have their own software that you can install. Some brokers offer advanced trading platforms with technical analysis tools and real-time market data, while others offer basic platforms that are suitable for new investors. You can find out which app has the best interface by performing some research or reading reviews. An account with an intuitive interface that does not lag can be helpful and convenient.

Investment Products and Services

Different brokers offer different investment products and services to cater to the needs of different investors. Some brokers may offer a wide range of products such as equities, derivatives, mutual funds, etc. while others may focus on specific products such as options trading. It is important to choose a broker that offers the products and services that align with your investment goals.

Customer Support

Good customer support is essential when it comes to investing. It is important to choose a broker that offers prompt and efficient customer support, whether it is through email, phone, or chat. Additionally, the broker should have a user-friendly website and FAQ section for quick resolution of issues.

Choose the Best Online Broker

Based on the parameters mentioned above, some of the top stock brokers in India are Zerodha, Upstox, and Angel Broking. Zerodha is known for its low brokerage charges and easy account opening process. Upstox offers a user-friendly trading platform and a wide range of investment products and services. Angel Broking has a strong reputation in the industry and offers excellent customer support.

In conclusion, choosing the right stock broker is crucial for a successful investing journey. By considering the parameters mentioned above, investors can compare different brokers side by side and choose the one that best matches their needs. Ultimately, it is important to do your own research and make an informed decision based on your investment goals and style. It's also a good idea to read reviews and ask for recommendations from other investors before making a final decision.