What is Social Trading?

Who doesn’t need companions in life? We simply need others to varying degrees, based on our personalities and interests, in various fields. The stock market is no different. Many have observed that trading with friends, peers, or experts helps thrive the entire investing experience.

Social Media: Defining new age investing for Millennials

The internet is changing the way people invest. Time spent in front of a screen, huge liquidity in the markets, and almost zero-brokerage trading has contributed to a new and young population of retail investors, a number of whom began trading in the public markets in 2020. In the 2020 calendar year, Demat accounts in India increased by more than 10 million. Young investors primarily drive the rise in investor accounts. With being receptive to new-age technologies, it may not be wrong to call the young retail investors the bulls of the new era of the stock market.

With only 1347 SEBI registered financial advisors for the entire Indian population, as on date Dec 25, 2022, people are turning to social media platforms to identify stock market trading opportunities. Mainly, millennials with limited financial knowledge are most likely to turn to social media influencers to educate themselves on investing.

Social media has become fully integrated into the daily lives of most Gen Zers. According to a March 2021 survey by CreditCards.com in the US, Gen Z investors were nearly five times as likely to report that they get financial advice from social media as adults aged 41 and over, with 28% turning to friends and online influencers for guidance. The survey also found that Gen Z was more likely to seek financial advice, with nearly 80% reporting receiving advice versus 64% of Gen X investors and 60% of Baby Boomers.

As per Motley Fool, in the US, 91% of Gen Z report having used social media for investing research, more than any other source of information. Of the social media platforms, 71% of Gen Z report using YouTube videos for financial information over the past month, 42% reported using Reddit, 36% used TikTok videos, 28% used Facebook, 32% used Twitter and 27% used Instagram.

Social Trading Explained: Where social networks and investing come together

Social Trading is a form of investing that allows investors to observe the trading behavior of their peers and expert traders and mimic them. In this, members of the community are able to earn money with collaborative efforts. This is done through social trading platforms, which make it easy and convenient for investors to check out other traders’ activity, then implement those same moves in their portfolios.

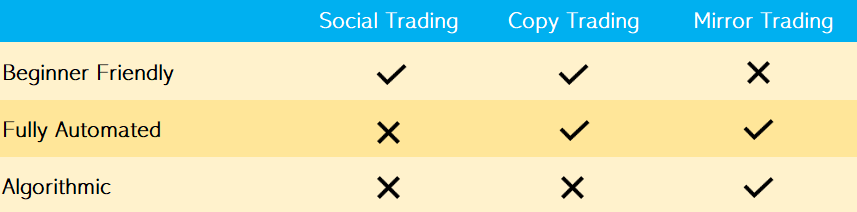

Social trading vs Copy Trading vs Mirror Trading

Social trading is similar to but not the same as mirroring or copying another investor’s trades. Social trading is more of a general concept where a pro trader posts their thoughts, company news, charts, market analysis, suggestions, etc., and others subscribe to it. The followers may mimic precisely what the pro-investor said; some may tweak it up a bit. It is completely up to the followers what they want to do with an expert’s trades. In social trading, users may have an opportunity to interact with traders and their trades, and learn from them to enhance their own investing knowledge.

On the other hand, Copy trading is a type of social trading where the trades are automated, and the assets owned by the user are based entirely on the other trader’s picks. The user doesn’t really have to go through the learning curve to be able to start seeing some returns. All they have to do is proportionally allocate whatever their balance is, into the stocks in the trader’s portfolio. This way, the total sum could be invested in multiple portfolios. At the same time, the risks would be reduced, and the user would have the option of testing out different top traders.

In Mirror trading, the autonomy of individual investors is completely compromised, and the assets are traded based on algorithmic strategies. The user has to choose from a list of trading criteria and customize their own trading strategies. These criteria include investment goals, the user’s preferred asset classes, and risk tolerance. Mirror trading is basically applying general strategies from various top traders into a portfolio instead of copying the trade just as it is.

Investing with Friends: Stock market trading simplified for Beginners

The rise of social trading has opened people to sharing their investing ideas, and their thoughts about what to buy or what to sell. People can now see how and what the experts are trading. The social angle is providing less-experienced investors with the opportunity to leverage the expertise of experienced traders. Not just experts, retail investors are bringing their friends and family into their trading circle. For example, some retail investors are following the stocks which politicians, or their spouses trade.

Getting into trading is a choice that can potentially be difficult and stressful for beginners. By investing with friends, the user facilitates his discovery of the stock markets by adding a social dimension. They can follow the investments of a friend who carries the knowledge of stock market trading, share their latest performance to educate their friends, or even encourage their friends to start trading with them.

Observing this trend, various social trading and investment platforms have emerged in India as well for guiding individuals to invest in the stock market. Almost all the platforms allow users to interact with experts and community members to enhance their trading and investing skills. They all root for a similar mission of democratizing access to the stock market. However, there are various structural differences among these platforms that differentiate their approach to solving for efficient and effective social trading.

Covesto: Online trading with friends, family, and experts

Among the many, Covesto is steps ahead in introducing true transparency in social trading. Covesto not only allows the users to see and replicate the trades and portfolios of other traders but also allows them to check their true track record.

Experts can create trading profiles backed by their performance and verified returns to build credibility. Followers, on the other hand, can take a smart and informed decision regarding following a particular trade by seeing the trader’s recent and historical performance, observing the returns on various assets, and knowing the distribution of his different investments.

To get started, users simply need to sign in and create their profiles. Then, it is up to the user to either follow the top traders displayed on the trending page or connect with close friends to trade together. Covesto is just like any other stock trading platform where users can execute their trades, see them perform in the live markets, and exit from them anytime. The only difference is that people in your network can peek into your portfolio holdings, interact with your investing ideas and replicate any trade of their choice. This transparency facilitates true stock market learning at no cost.

Learning the ways of the stock market can be hard, but being a part of an active community of experts can make it easier! Covesto is a knowledge-sharing platform for investors where they can share their expertise on the stock market and good investment ideas with fellow investors. Head over to Covesto and start your journey of community investing today!

Feature Image