Rising Potential of the Indian Capital Market

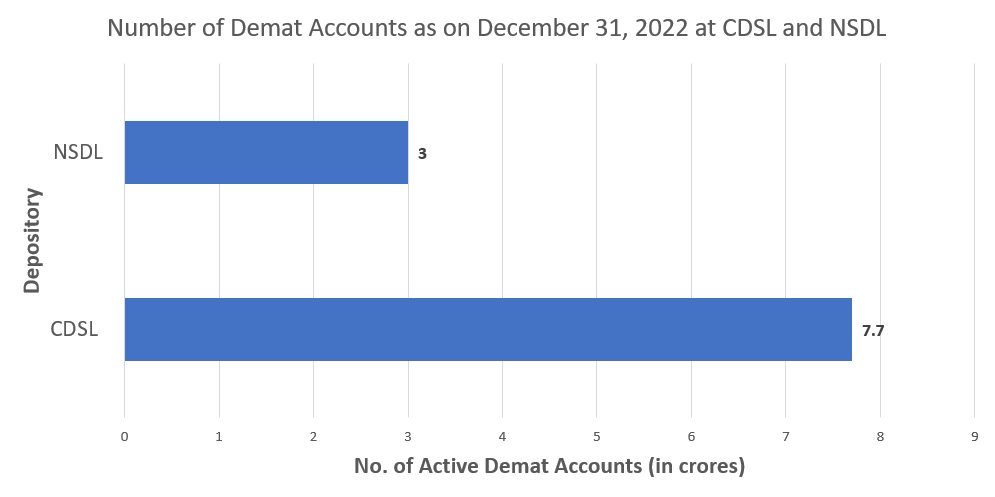

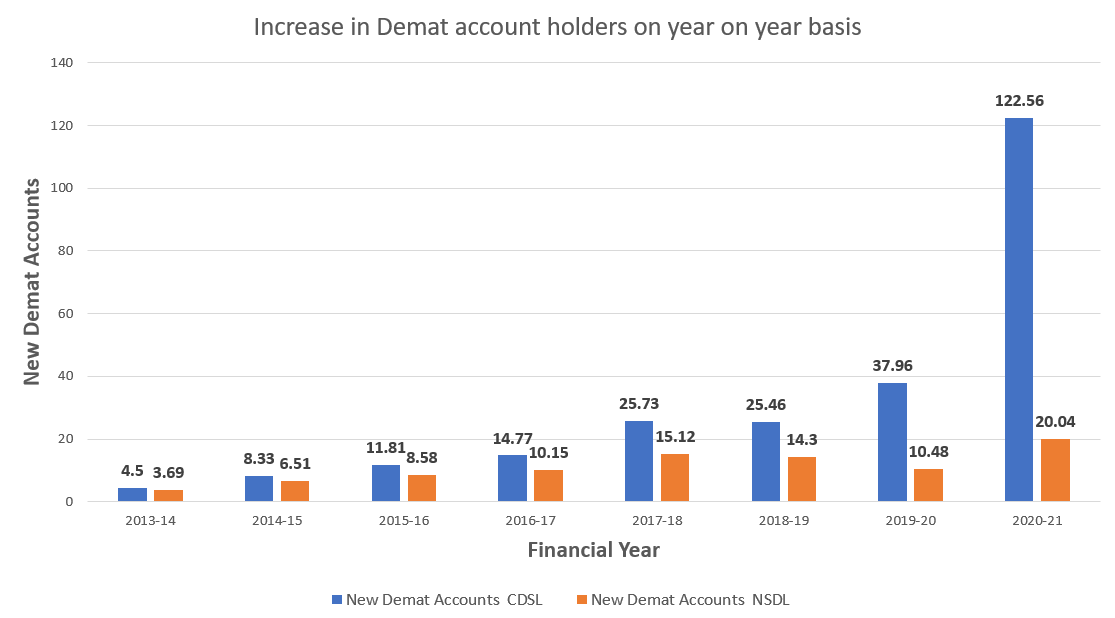

The Indian Capital Market saw a dazzling rise in the number of Demat accounts since the pandemic hit. The total number of Demat accounts has tripled in the last three years, thanks to a robust investment climate and technology-anchored transparent trading system across the country. Both depositories – NSDL and CDSL – reported a cumulative Demat account number in India at a record 100 million, an increase of 145 percent from 40.9 million reported in the pre-Covid pandemic days. One standout feature of a relatively rapid influx of investors in the stock market investments is the role played by millennials. In the 2020 calendar year, Demat accounts in India increased by more than 10 million. Young investors primarily drive the rise in investor accounts.

Retail investors share growing in the growing equity market

Post the market crash of March 2020, retail investor participation in the Indian capital market has been witnessing explosive growth. The Indian equity markets outperformed most of its global peers. The share of retail investors in companies listed on the National Stock Exchange (NSE) reached an all-time high of 7.42% as of March 31, 2022, up from 7.33% as of December 31, 2021. In the same period, in rupee terms, retail holding in companies listed on NSE reached an all-time high of Rs. 19.16 lakh crore (US$ 240.17 billion), up from Rs 19.05 lakh crore (US$ 238.8 billion) on December 31, 2021. Retail investors now account for 52 percent of daily transactions in the market with DIIs and FIIs accounting for 29 percent and 19 percent respectively. Clearly, the equity cult in India is spreading.

A thriving environment for stock market investments

The capital market in India still possesses a huge potential for further growth which can automatically translate into a further increase in the number of Demat accounts. There is a significant gap in equity investments in the country compared to the total population. Currently, nearly 7 percent of India’s population has access to equity markets, as against over 14 percent in China and 65 percent in the USA. Given the speedy economic growth, India’s growth potential in the capital markets can be attributed to the following factors -

Addressing under-penetration in tier 2, 3, and beyond cities

Until a few years back, investments were limited to just a few; the ones with in-depth financial knowledge, huge amounts of capital, or acquaintance with a broker. However, things are rapidly changing. There is a high probability that either you are a stock market investor or know someone who invests.

A gradual increase in new-age digital investing platforms (FinTechs) makes the process easier. Earlier, this digital route was limited to the urban belt of the country. However, more people from across India (tier 2, 3 & 4 cities), including those who were earlier unfamiliar with the way investments were done, have started participating in the financial markets in India.

However, against a population of 140 crores, Indian capital markets remain deeply underpenetrated. With approximately 65 percent of India’s population residing in non-urban areas, which are largely under-penetrated, this forms a large addressable market. The stock and equity markets in India require to reach villages where massive wealth remains mostly idle for months and years.

Moving from saving to investing culture

India has been traditionally a nation of savers. People here have managed to spend less than their income and save the maximum possible amount out of regular income for securing their future. This has also meant the postponement of current consumption for a better future. People have done reasonably well post-retirement, mainly because of this savings “culture”.

However, with Internet penetration and the availability of affordable data, Indians are also learning to invest their savings wisely. Entering the equity market was commonly understood as a loss-making proposition at least in the beginning in absence of deeper market understanding and knowledge of financial instruments including equities.

The pandemic-led nationwide lockdown gave people ample amount of time to learn about stock investing and try their hands at it. Also, the work-from-home culture helped people save a lot of money which motivated them to invest their savings in the equity markets when the other financial institutes didn’t offer considerable returns. The lack of employment and income sources during the pandemic outbreak induced people to explore alternative sources of income. All these factors have brought a behavioral shift among the Indian population, which is here to stay.

Also, retail investor participation in the capital market is desirable. It promotes the financialization of savings which, in turn, channelizes savings from unproductive assets like gold into productive investment, thereby contributing to higher capital formation and economic growth. It enables investors to participate in wealth creation happening through the capital market.

Adoption of new-age technologies

Technology is transforming economies as businesses and industries move towards adopting advanced solutions such as digital payments, online banking, and cashless transactions. Digital technology in capital markets is changing market operations.

In fact, the technological progress in capital markets is offering opportunities to boost flexibility, scale efficiencies, and reduce complexity in how the markets operate. The impact of disruptive technology on capital markets is as significant as the fire was to the cavemen.

Well, the new technology-aided solutions are only adding to the human capacities in the capital market scenario. India has seen the launch of 5G technology which would help smartphone users to trade in stocks directly from anywhere. With the rapid increase in smartphone users, connecting them with the equity market would require only a small effort. App-based trading platforms such as Zerodha, Upstox, Groww, Covesto, etc have made the process of opening a Demat account and trading in the stock market convenient, which is encouraging many to start trading while staying in their comfort zones.

Al and Blockchain have opened a lot of avenues to improve the trading ecosystem such as faster settlements, real-time monitoring, improved insights, and enhanced security measures. Also, all the required information about any company and the stock market is made available at the fingertips of the investor by technology-driven platforms which helps them make an informed decision.

In a nutshell, it is time that investors in the industry embrace these new-age technologies which are further going to transform the capital markets ecosystem in the upcoming years. Therefore, the way forward is to leverage technology and apply it in creative ways to develop the markets.

The growing popularity of stock trading among the youngsters

Millions of millennials have taken to stock trading during the pandemic, raising hopes that the appetite for equities in the world’s second-most-populated nation is finally growing. Angel Broking, a securities firm established in 1987, says 72 percent of the 510,000 customers it added from October to December had never traded stocks before.

It’s not just millennials coming in. Brokerages are also seeing the entry of Gen Z customers – investors under the age of 25, and in their first job. Brokerages are consequently investing in youth-friendly ‘Super Apps’, which provide a full product portfolio, including investing and financial management services, in a single app. For many in the brokerage industry – from ICICI Securities to 5Paisato Kotak Securities – the mantra these days is simplifying the user experience so that new entrants in the stock market are able to understand and trade in a range of products, from not just stocks but also options and derivatives.

While the popularity of trading in equity among the young population has been increasing consistently, still there is wide room to boost it further. Young investors need to be “brave” and shall put in the maximum of their wealth in equity, starting from investing and then venturing into trading. While that’s an aggressive strategy, there is much to gain from being bullish on the stock market in a country like India, which is young, dynamic, and increasingly impatient for growth.

Way Forward: Awareness and education should go hand in hand

The responsibility of making sound investment decisions cannot solely depend on investors. Along with creating awareness, it is equally crucial to educate them.

More initiatives by regulatory bodies like SEBI, fintech players, and other stakeholders to educate the audience about how to make stock market investments, sustain them, and carry out stop-loss buybacks.

All stakeholders' collective obligation is to ensure a secure and regulated system. In essence, the interest of the investors should be at the core.

Covesto is one such platform that aims at simplifying stock trading and investing for Indian retail investors. The platform allows its users to connect with expert traders and discuss stock market opportunities together.

Experts can create trading profiles backed by their performance to build credibility. Followers, on the other hand, can take a smart and informed decision regarding following a particular trade by seeing the trader’s recent and historical performance, observing the returns on various assets, and knowing the distribution of his different investments.

With the collaborative efforts of your trading community, identify the right trading opportunities and never miss any major stock market action. Join the fastest-growing trading community - Covesto now.